Hawthorn Parish Council

Chairman : Cllr. Diane Hughes

Parish Clerk : Lesley Swinbank BSc MBA, Fellow SLCC

Springwell House, Sedgefield, Co. Durham. TS21 2HS

07950 944275

clerk@hawthornparish.co.uk

Financial and Audit Information

The Council's financial arrangements are governed by statute and included in it's Financial Regulations.

The financial year runs from April 1st until 31st March of the next year.

Hawthorn Parish Council is funded directly through a precept collected via the Council Tax on the residents of Hawthorn. The precept is required to be sent to Durham County Council by the end of January each year.

The expenditure for the Parish Council includes the salary of the Parish Clerk, grants and donations to local groups, local events and general maintenance of the open spaces and play area.

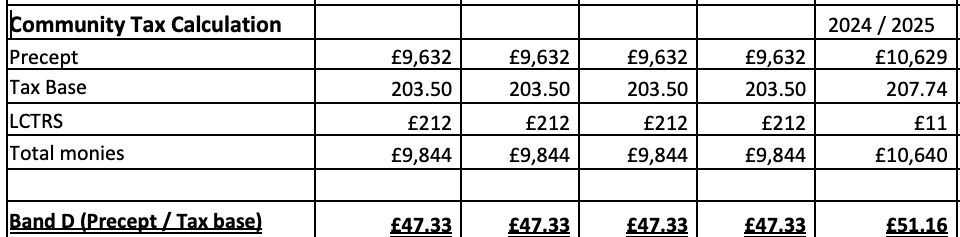

The information re the precept / council tax for 2024 / 2025 is shown below.

Audit 2023/ 2024

Full information on the audit here

The Council accounts are examined by the Internal Auditor every year at the end of the finacial year but as the Parish Council has neither income nor expenditure over £25,000 it now is able to certify the council as exempt each year from a limited assurance review under Section 9 of the Local Audit (Smaller Authorities) Regulations 2015.

The accounts must still be approved by full council and the AGAR (Annual Governance and Accountability Return) competed and published on this website.

The public have the right to look at / inspect the acounts. You can do this between certain dates - but these dates must include July 1st - 14th, and the form which states how and when you can look at the accounts must be published on the Council's website the day before the accounts can be viewed. This is a statutory regulation.

For this year ( 2023 / 2024 ) the accounts will be available for viewing here once approved.

Current Financial Information

The Council prepares its estimates and budgets each year in November / December ready to set the precept in January and also prepares a financial plan.

In addition the Council must carry out a financial risk assessment for each year and review the effectiveness of the Internal Audit.

These will be available once approved by the Parish Council.

The Council also ensures that proper insurance is in place - including public liability, employer's liability and general insurance.